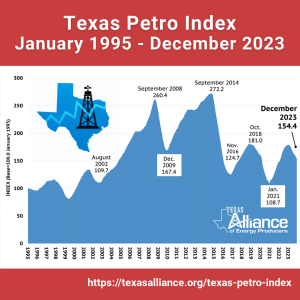

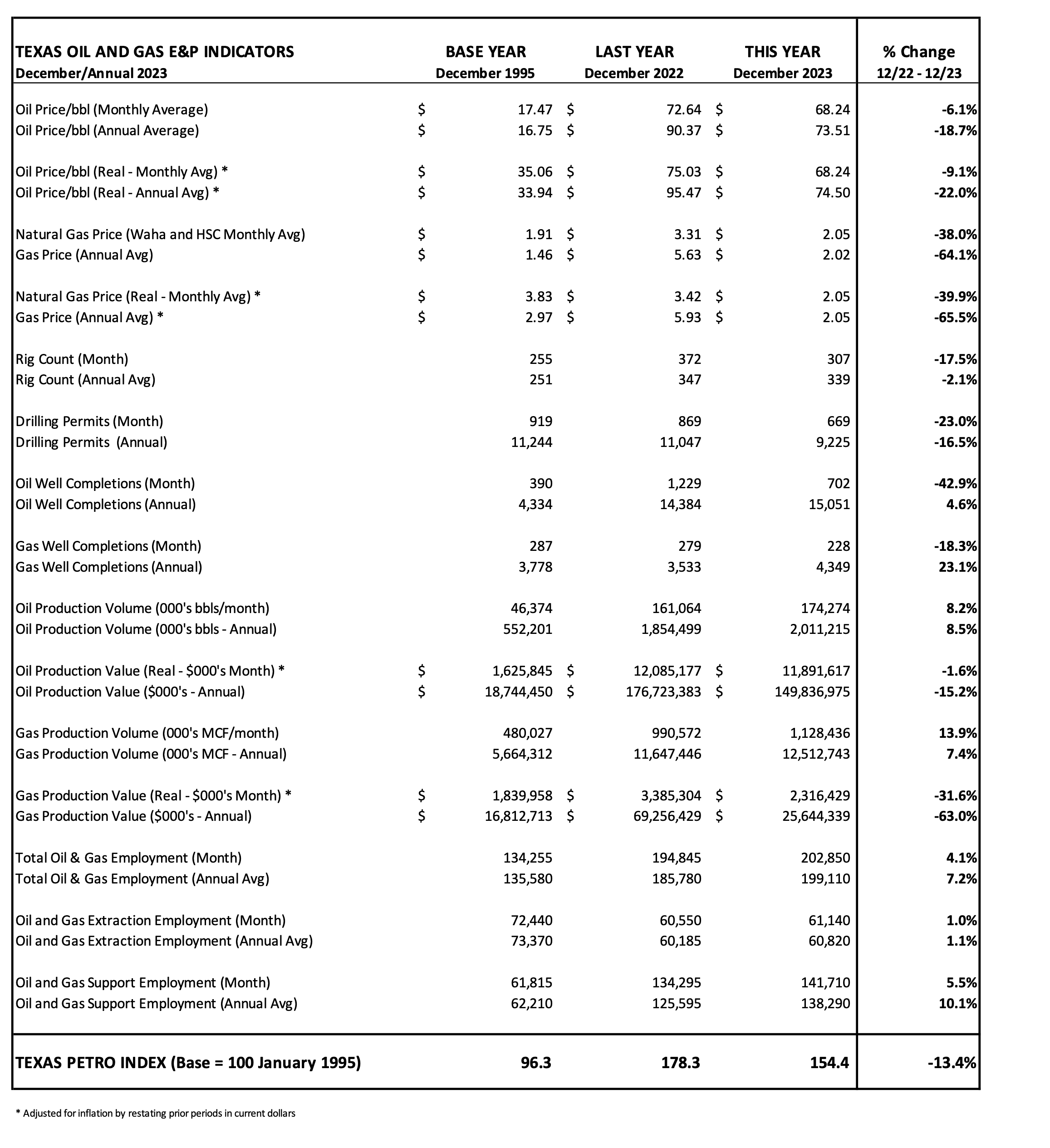

Texas Petro Index: Texas Upstream Activity Declines in 2023, Even as State Sets New Production RecordsAUSTIN, Texas (Feb. 5, 2024)—The year-end Texas Petro Index (TPI), released by the Texas Alliance of Energy Producers, shows steady declines in nearly every exploration and production indicator in 2023. At the same time, however, Texas set records for both crude oil and natural gas production last year, despite lower prices for both, falling rig counts, and fewer drilling permits issued than in 2022.

(Click on each graph for a larger version.) "Rising crude oil and natural gas production and still-growing industry employment were unable to offset lower prices, fewer rigs at work, and lower values of statewide production, pushing the TPI downward in 2023 after the January peak," said Karr Ingham, Petroleum Economist for the Texas Alliance of Energy Producers, and the creator of the TPI analysis. "But Texas oil and gas producers, with extraordinary efficiency and productivity gains on full display, still managed to grow production significantly, setting new records for statewide output along the way." Statewide crude oil production in Texas surpassed two billion barrels for the first time ever in 2023, and reached a record 5.62 million barrels per day in December 2023. Daily production, which peaked pre-COVID at 5.45 million barrels in March 2020, finally reached and exceeded that level fully three years later in March 2023. Texas annual crude oil production in 2023 outpaced the 2022 annual total by a stout 8.5%, and comprised 42.6% of U.S. annual production. Texas natural gas production exceeded 12 trillion cubic feet (TCF) for the first time at an estimated 12.5 TCF in 2023, an increase of 7.4% over the 2022 annual total. Surprisingly, however, these milestones were accomplished with a significant and sustained decline in the statewide rig count and fewer drilling permits issued over the course of the year. The Texas rig count climbed to its post-COVID high of 379 in January 2023, and then fell by 76 rigs to 303 in November, before adding four rigs in December. At year-end 2023 the rig count was down by nearly 18% compared to the December 2022 monthly average. At the same time the number of drilling permits declined by 16.5% in 2023. Direct upstream (exploration and production) employment was revised downward by about 9,000 in late 2023, but continued to improve through year-end from the lower benchmark levels, surpassing 200,000 jobs in December for the first time since March 2020. According to the latest and best data*, oil and gas E&P employment increased by 4.1% at year-end compared to the December 2022 monthly estimate, reflecting the addition of about 8,000 jobs over the year. "It’s an unusual set of circumstances,” said Ingham. "Steadily climbing volumes of crude oil and natural gas production with steadily falling rig counts and drilling permits, and an industry employment base that is a third smaller than it was less than 10 years ago." "Texas is increasingly leading the way in terms of supply growth domestically and globally, helping to meet the ever-growing demand for abundant, affordable, and reliable energy at home and around the world," said Ingham. "For this, oil and gas operators in Texas of all shapes and sizes are worthy of thanks, not scorn, and their accomplishments in powering our economy, improving our everyday lives, and enhancing America’s energy security should be widely celebrated." Findings of the December/Year-end 2023 Texas Petro Index include:

*Operating and producing companies, service companies, and drilling companies; two-step seasonally adjusted and early benchmarked by the Federal Reserve Bank of Dallas, with additional adjustments by TAEP About the Texas Petro IndexThe Texas Petro Index (TPI) is a monthly measure of growth rates and cycles in the Texas upstream oil and gas economy. The TPI is calculated based on a comprehensive group of exploration and production (E&P) indicators, which include crude oil and natural gas wellhead prices, rig count, drilling permits, well completions, volume and value of Texas crude oil and natural gas production, and industry E&P employment. Karr Ingham, Petroleum Economist and Interim President of the Texas Alliance of Energy Producers, created the TPI in January 1995 (based at 100.0) and releases it monthly. For more information, visit https://texasalliance.org/texas-petro-index. About Texas Alliance of Energy ProducersThe Texas Alliance of Energy Producers is the largest and most effective statewide oil and gas association for independents in the nation. Serving nearly 3,000 members, the Alliance provides a voice for sound U.S. energy policy. These individuals and organizations—from small players to publicly traded companies—are the driving force behind the U.S. energy renaissance. Founded in 1930, the Alliance has offices in Wichita Falls and Austin, Texas. For more information, visit https://www.texasalliance.org. |